Homeowners Insurance in and around Birmingham

Birmingham, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Alabaster

- Bessemer

- Calera

- Fultondale

- Gardendale

- Helena

- Homewood

- Hoover

- McCalla

- Mountain Brook

- Vestavia

Home Is Where Your Heart Is

You have plenty of options when it comes to choosing a home insurance provider in Birmingham. Sorting through coverage options and providers isn’t easy. But if you want great priced homeowners insurance, choose State Farm. Your friends and neighbors in Birmingham enjoy impressive value and hassle-free service by working with State Farm Agent Tameka Holmes. That’s because Tameka Holmes can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as collectibles, appliances, mementos, sports equipment, and more!

Birmingham, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Tameka Holmes can be there whenever mishaps occur, to get you back in your routine. State Farm is there for you.

So visit agent Tameka Holmes's team for more information on State Farm's excellent options for protecting your home and possessions.

Have More Questions About Homeowners Insurance?

Call Tameka at (205) 986-0179 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Basement storage ideas

Basement storage ideas

Finished and unfinished basement storage can be tricky. Consider these tips to help keep the right things in your home's lower level.

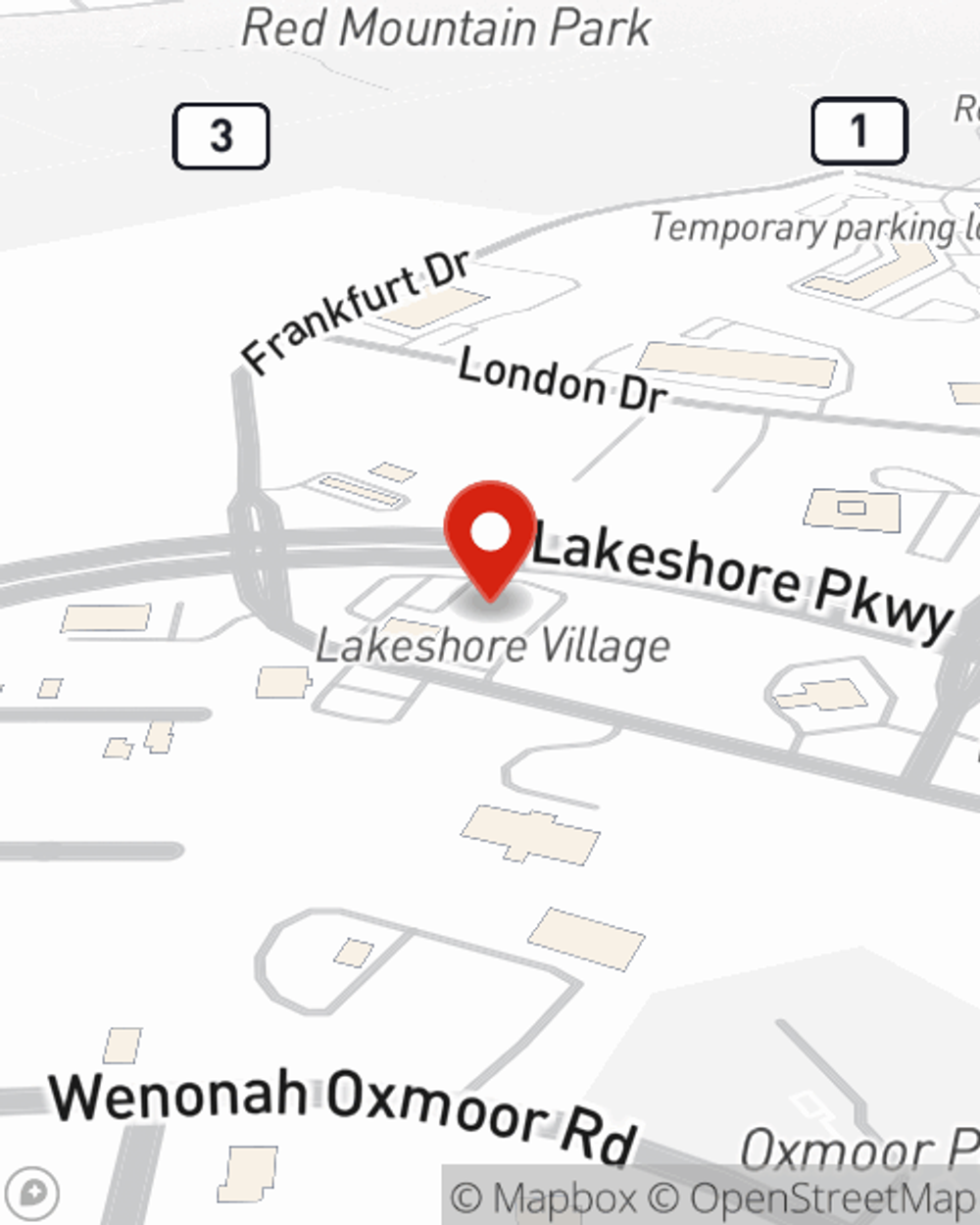

Tameka Holmes

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Basement storage ideas

Basement storage ideas

Finished and unfinished basement storage can be tricky. Consider these tips to help keep the right things in your home's lower level.